Medicare Supplement plans sold with effective dates for coverage on or after January 1, 2020

Plan Comparisons

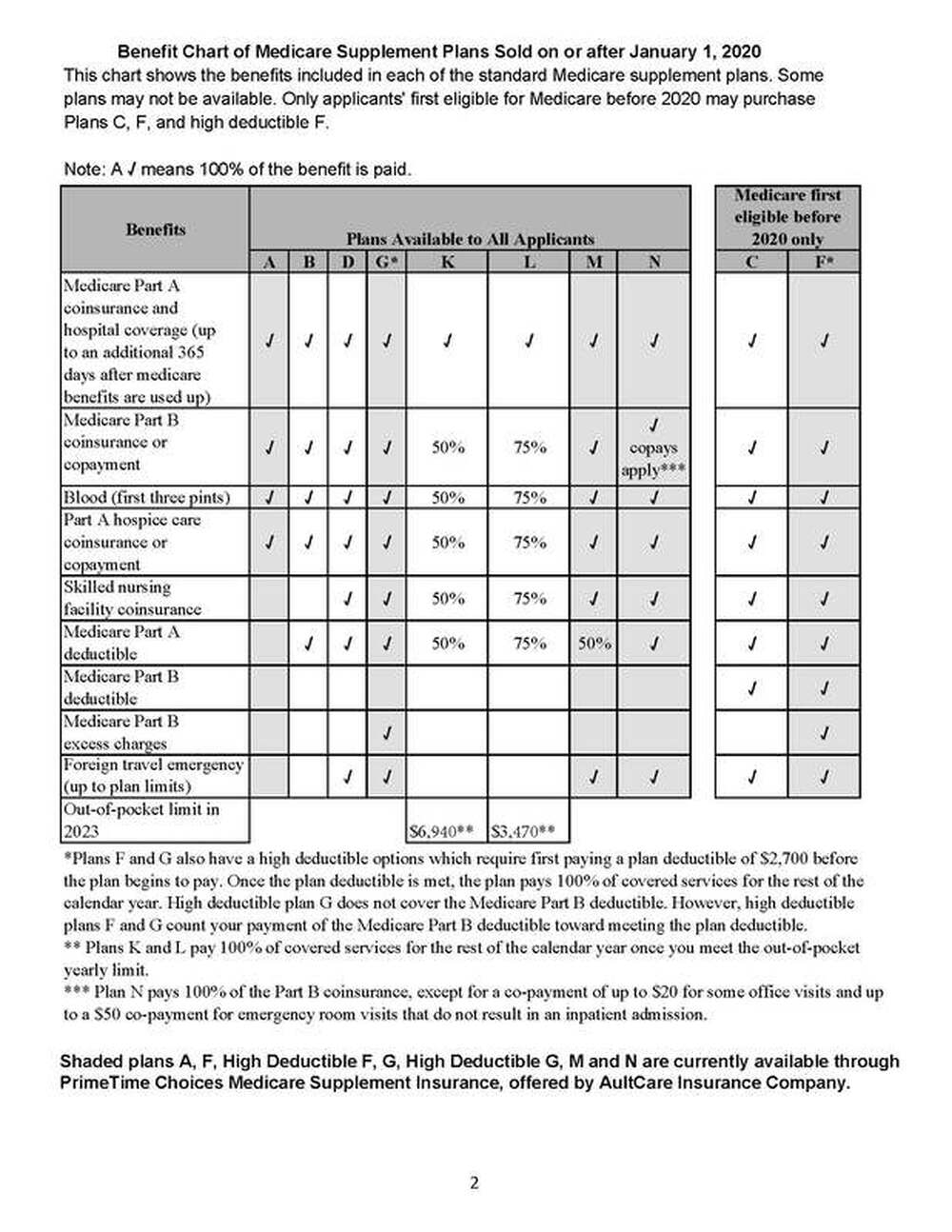

Benefit Chart of Medicare Supplement Plans Sold on or after January 1, 2020

This chart shows the benefits included in each of the standard Medicare supplement plans. Some plans may not be available. Only applicants' first eligible for Medicare before 2020 may purchase Plans C, F, and High deductible F.

This chart shows the benefits included in each of the standard Medicare supplement plans. Some plans may not be available. Only applicants' first eligible for Medicare before 2020 may purchase Plans C, F, and High deductible F.